Distributions

Our platform provides easy to use, step by step navigation to assist you in the set-up, scheduling, and review of your payment as well as the management of your retained and failed payments in a few easy steps.

Try for free

Flexibility to choose how you calculate your distributions

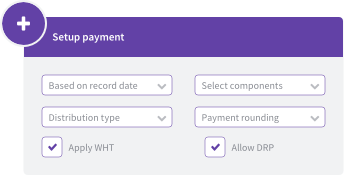

Our payment centre has an array of features and options to assist you in creating a detailed payment for your investors, including distribution re-investments plans.

Payment entitlement can be based on an investor’s holding as at a date or based on the average amount they hold over a specified time period.

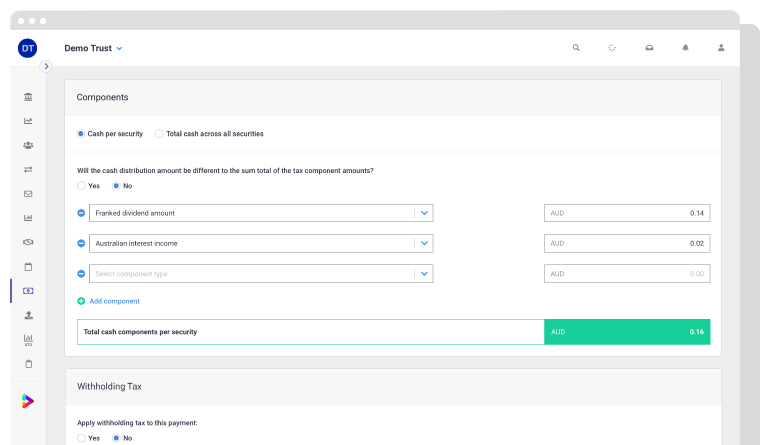

Distribution statements, withholding tax and payments

Distribution statements are created for each investor and can be disseminated automatically by email or manually by post.

Withholding tax amounts are calculated based upon estimated tax components and each investors profile (e.g have they provided a tax number and what country is their tax residency) using either the rate we expect is applicable or what you define and the amount is deducted from their payment entitlements.

Pay your distributions easily by downloading an ABA file for your bank or by cheques.

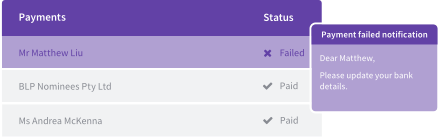

Manage retained and failed payments

If a payment is retained or fails due to issues with bank account details or address data, the system will notify the investors with a valid email address and update the payment portal to show the number of payments that have been retained.